Land Tax Examples . the land betterment charge is a tax on the increase in value of land, most commonly paid by developers. land tax is calculated by applying the appropriate land tax rate to the total taxable value of your land holdings,.

from www.weeklytimesnow.com.au

land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. in common usage, property tax refers to a tax on immovable possessions like structures or land. A land value tax ( lvt) is a levy on the value of land without regard to buildings, personal property and other improvements upon it.

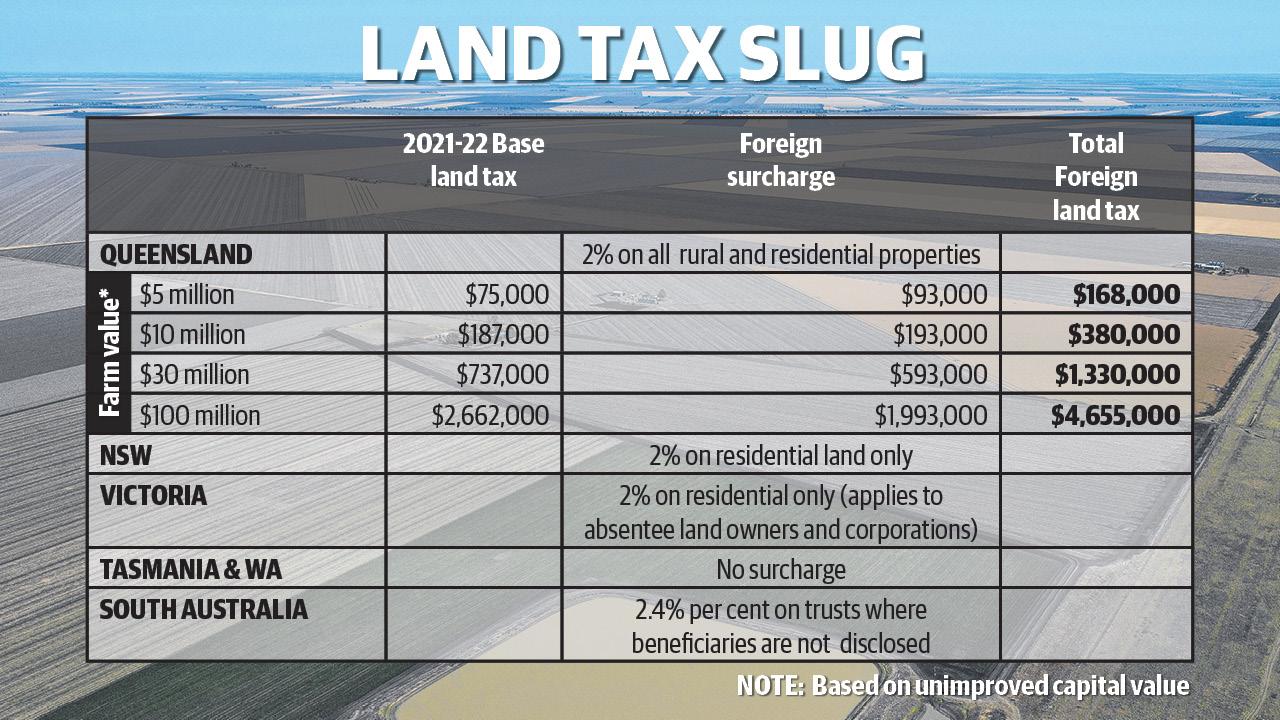

Land tax of up to 4.65 per cent hits foreign farmland investors in Qld

Land Tax Examples land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. land tax is calculated by applying the appropriate land tax rate to the total taxable value of your land holdings,. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax.

From www.cityofmadison.com

Real Property Tax Bill Sample Property Taxes ePayment Center City Land Tax Examples land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. Some local jurisdictions also assess. in common usage, property tax refers to a tax on immovable possessions like structures or land. Annual property tax is calculated by multiplying the annual value (av) of the property. Land Tax Examples.

From www.zricks.com

What is Land Tax? Land Tax Examples Some local jurisdictions also assess.land tax is assessed on a calendar year basis on the land you own at midnight on 31 december before your assessment is. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. land tax is calculated by applying the appropriate land tax rate to. Land Tax Examples.

From www.sro.vic.gov.au

Land tax calculation examples State Revenue Office Land Tax Examples Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. It is also known as a.land tax is assessed on a calendar year basis on the land you own at midnight on 31 december before your assessment is. Some local jurisdictions also assess. land value taxes are examples of. Land Tax Examples.

From performanceproperty.com.au

Queensland’s Rise in Land Tax Land Tax Examples the land betterment charge is a tax on the increase in value of land, most commonly paid by developers. A land value tax ( lvt) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. in common usage, property tax refers to a tax on immovable possessions like structures. Land Tax Examples.

From www.infotrack.com.au

Land Tax Clearance Certificate InfoTrack Land Tax Examples A land value tax ( lvt) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. It is also known as a. Some local jurisdictions also assess. the land betterment charge is a tax on the increase in value of land, most commonly paid by developers.land tax is. Land Tax Examples.

From www.scribd.com

Tax Declaration Sample PDF Taxes Public Finance Land Tax Examples Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. the land betterment charge is a tax on the increase in value of land, most commonly paid by developers.land tax is assessed on a calendar year basis on the land you own at midnight on 31 december before your. Land Tax Examples.

From blog.turbotax.intuit.com

Real Estate Taxes vs. Property Taxes Intuit TurboTax Blog Land Tax Examples the land betterment charge is a tax on the increase in value of land, most commonly paid by developers.land tax is assessed on a calendar year basis on the land you own at midnight on 31 december before your assessment is. Annual property tax is calculated by multiplying the annual value (av) of the property with the. Land Tax Examples.

From www.xcessbooks.com

Capital Gain On Sale Of Agricultural Land & Tax Planning For Land Tax Examples land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. Some local jurisdictions also assess. It is also known as a. in common usage, property tax refers. Land Tax Examples.

From www.pitcher.com.au

Changes to Victoria’s land tax primary production exemption Pitcher Land Tax Examples in common usage, property tax refers to a tax on immovable possessions like structures or land. A land value tax ( lvt) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Some local jurisdictions also assess. Annual property tax is calculated by multiplying the annual value (av) of the. Land Tax Examples.

From www.divinalaw.com

Taxes on land purchase in Phl DivinaLaw Land Tax Examples Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. It is also known as a. in common usage, property tax refers to a tax on immovable possessions like structures or land. land value taxes are examples of ad valorem taxation and are favored by some economists since land value. Land Tax Examples.

From burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns Land Tax Examples A land value tax ( lvt) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. in common usage, property tax refers to a tax on immovable possessions like structures or land.. Land Tax Examples.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law Land Tax Examples land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. It is also known as a. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. the land betterment charge is a tax on the increase in. Land Tax Examples.

From brisbane.nationalpropertybuyers.com.au

How Proposed Changes to QLD Land Tax Rules Impact Investors Land Tax Examples land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. A land value tax ( lvt) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Some local jurisdictions also assess. in common usage, property tax. Land Tax Examples.

From www.legislation.gov.uk

The Stamp Duty Land Tax (Administration) (Amendment) Regulations 2011 Land Tax Examples the land betterment charge is a tax on the increase in value of land, most commonly paid by developers. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax.land tax is assessed on a calendar year basis on the land you own at midnight on 31 december before your. Land Tax Examples.

From wslegal.com.au

Can you Object to a Land Tax Assessment? Wollerman Shacklock Lawyers Land Tax Examples the land betterment charge is a tax on the increase in value of land, most commonly paid by developers. land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. Annual property tax is calculated by multiplying the annual value (av) of the property with the. Land Tax Examples.

From www.dochub.com

Delinquent property tax letter samples Fill out & sign online DocHub Land Tax Examples land tax is calculated by applying the appropriate land tax rate to the total taxable value of your land holdings,. in common usage, property tax refers to a tax on immovable possessions like structures or land. It is also known as a. the land betterment charge is a tax on the increase in value of land, most. Land Tax Examples.

From www.sampleforms.com

FREE 8+ Sample Land Appraisal Forms in MS Word PDF Land Tax Examples the land betterment charge is a tax on the increase in value of land, most commonly paid by developers. land value taxes are examples of ad valorem taxation and are favored by some economists since land value tends to be more stable. in common usage, property tax refers to a tax on immovable possessions like structures or. Land Tax Examples.

From www.tasmanianrentalowners.com

Land Tax Who can deliver? Land Tax Examples land tax is calculated by applying the appropriate land tax rate to the total taxable value of your land holdings,. Some local jurisdictions also assess. the land betterment charge is a tax on the increase in value of land, most commonly paid by developers. It is also known as a. in common usage, property tax refers to. Land Tax Examples.